Debt is almost a dirty word. With student loans, credit cards and other types of debt being readily available, it’s important to learn about debt and understand how to use it as a tool to achieve your goals.

This material was developed for the workshop “Understanding Debt”, delivered in the Pat Hanan Room on Saturday, 31 August 2019. The resources have been adapted for you to use independently. Follow FutureMakers to see when this workshop will be held again.

For resources on understanding your own money habits, how to adapt them, and how to set a realistic budget, see the resources from the first Money workshop, “Understanding Money Habits“. This material is a valuable precursor to “Understanding Debt”.

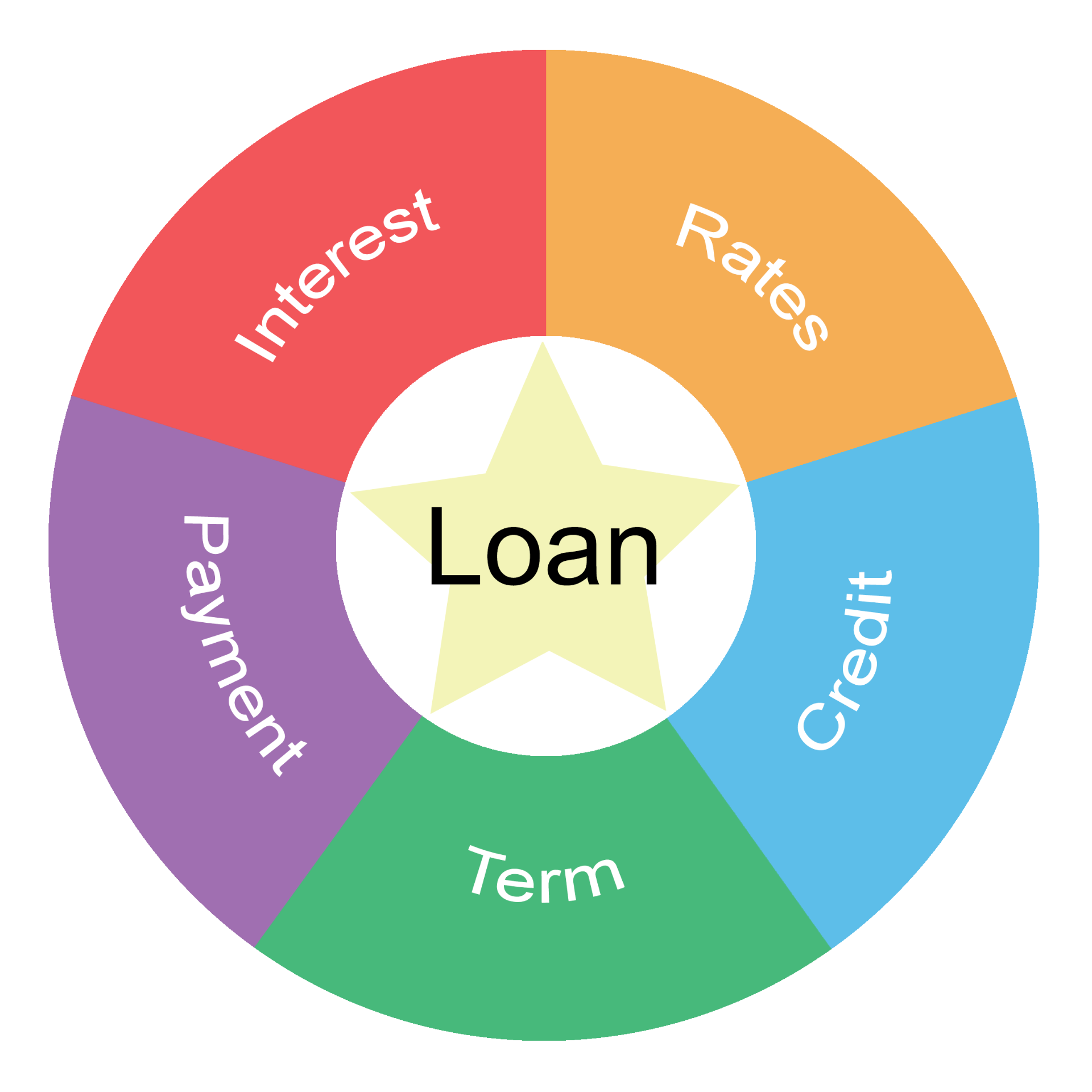

When talking about debt and money, it’s worth refreshing our understanding of the terms used:

- Credit: An agreement to be able to obtain goods or services without payment up front. Credit is based on the trust that this money will be paid back in the future.

- Debt: a sum of money that is owed or due.

- Interest: is the amount the bank or lender earns and charges for the use of the money that has been lent.

- Loan: a sum of money that is expected to be paid back within a certain timeframe, with or without interest.

- Loan payments: repayments of the loan. Often set out as a schedule with regular payments due monthly.

- Loan rate: The interest rate applied to a loan. Interest rates vary depending on the purpose and type of loan.

- Term: Loan term, is defined as the period of time between when a loan is received and when the loan is required to be fully repaid.

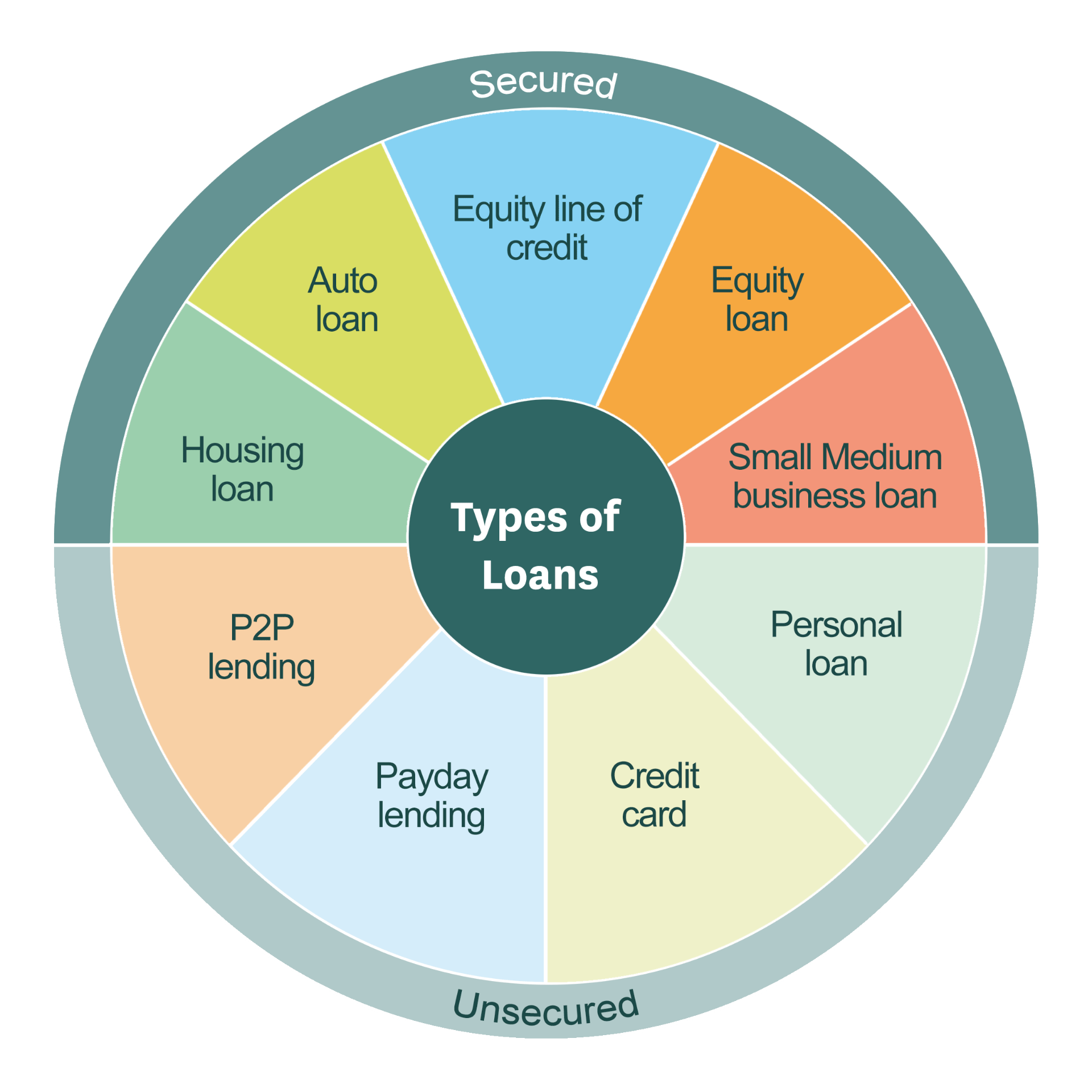

Secured loan: where something is put up for security. This is what will be repossessed should the loan repayments not be met. For example:

- Car loan where the car is security.

- Mortgage where the house is security.

- Equity loan: Something of value is put up to secure the loan.

- Line of equity: Usually money loaned against your house to do renovations or take a holiday.

- Business loan: where the business acts a security for the loan.

Unsecured loan: Where there is no security put up for the loan. However there will generally be higher interest rates for an unsecured loan. Examples of unsecured loans:

- Credit card.

- P2P lending: Peer to peer lending. People lending money for others to use.

- Payday lending: Money lent to get through to the next payday.

- Personal loan: Money borrowed for personal use.

What is good debt vs. bad debt

The following is adapted from an article by David Quilty on moneycrashers.com.

While most of us cannot live entirely debt-free, there are major differences between what is considered “good” debt and “bad” debt. Though some debt falls into a bit of a gray area, good debt is simply defined as money borrowed to pay for items you truly need or that appreciate in value, and bad debt is accrued for items you only want and that generally depreciate in value.

Defining wants and needs

Needs – The dictionary defines a necessity as “an indispensable thing” – something that everyone needs, e.g. food, clothing, health.

Wants – something unnecessary and expensive, e.g. designer clothing, meals out, new furniture for your flat and so on.

Before borrowing money, you need to determine whether the money is going toward something that will have a positive or negative effect on your overall financial situation. Ultimately, debt is not always bad – it’s how you use it that counts.

Good Debt

1. Borrowing money for education

When you take on a student loan, you are rarely making a bad decision. Just make sure you are taking the right degree for you as coming out without the degree and still the debt is not a good outcome. Generally, those with university degrees tend to earn more money over their lifetime than those without a degree.

2. Borrowing to buy a house

Value builders are assets that are likely to hold their value, grow in value or bring in income after we’ve paid for them. So they can be OK to go into debt for. A house is the classic value builder (although houses can lose value, too).As a rule, if we keep a house for the long term (more than 10 years) the value will increase or stay about the same. And, if we needed to, we could sell the house and pay back our debt.

3. Purchasing a car

If public transportation is not available in your area, or you cannot find anyone with whom to carpool, you are probably going to need to buy a car. A car loan can fall into that gray area between “good” and “bad,” debt but the key to keeping an auto loan closer to good debt rather than bad is to make sure you get the lowest possible interest rate on your loan. Also, it’s important to put as much down as possible, while making sure you still have cash on hand should you need it. Your best bet is to buy a late-model used car rather than a brand new one, potentially saving you thousands on the advertised price and the interest paid over the life of the loan.

4. Business loans

While this wouldn’t be considered good debt in every single case, borrowing money to start or expand a business is generally seen as a good idea, especially if business is booming. After all, it takes money to make money, right? Sometimes you have to borrow capital in order to hire new employees, buy new equipment, pay for advertising, or just to manufacture the first run of a new widget you invented. As long as the money is borrowed with a plan in place to generate more business or income, then taking out a business loan counts as good debt.

Bad Debt

1. Credit card debt

Credit card debt often piles up quicker than we realize, and is often used to pay for things we want rather than need. It’s much easier to think we can afford something using a card rather than paying with cash. By the time credit cards are paid off, high interest rates and minimum payments can turn $100 items into $200 items, and many items depreciate in value rapidly, making the loss that much more substantial. Credit card debt is without question a bad debt. It’s hard to get out of credit card debt and is best to avoid it in the first place.

2. Borrowing from a credit company

It may be easy to borrow money from credit companies, but it’s very difficult to pay them back. These companies loan out money with terrifyingly high interest rates, taking advantage of the fact that many people are desperate for cash. Even a small amount borrowed through a private loan business can end up costing a small fortune when finally paid back. These are often considered the worst kind of debt you can take on. If you are in serious need of a short-term loan, you are better off taking a cash advance on a credit card than borrowing money from these companies.

3. Hire purchase

Some retail outlets offer hire purchase agreements. Some offer 1-year interest free and no deposit for 1-year. Do not enter into these agreements unless you have the means to pay back or you can lose the item and anything you have paid, if you can’t meet the payments. However if you know you can pay back within a year it can be an okay way to buy necessities. Always make sure it is a need such as a new computer for business activity. A better way to go when managing debt is to purchase what you need as good second hand items on Trade Me and Facebook ‘buy, sell and swap’ pages. Many people are selling good gear for many reasons and it is amazing what you can pick up.

4. Vacations, jewellery, and expensive clothes

If you cannot comfortably afford to pay for these luxuries with cash on hand, don’t do it. These are not needs but wants, and thus bad debt. Wait until you have the money to pay for them. Going into debt just to pay for a vacation or a handbag is most definitely a terrible use of borrowed money.

Modern life requires many of us to borrow money at some point or another. But knowing the difference between good debt and bad debt can make a big impact on your financial health and chance of success.

It is best not to incur more debt than you can comfortably afford to pay back, regardless of whether it is good or bad. Also, don’t let debt add up to more than 36 percent of your total gross income, as credit agencies do not differentiate between good and bad debt when deciding your credit worthiness. Stay in charge of this yourself.

Do not be scared of debt as a general concept. Instead, use it as a tool when seeking to improve your life or your financial situation, to increase earnings, or to invest in your future.

1. Free up cash for repayments

You may not feel there’s room in your budget to make larger payments, but if you’re serious about being debt-free, you’ve got to make some changes. To free up cash to pay down your debt, you must try to cut your costs, increase your income, or both.

Reduce your expenses

Do a personal budget and review your monthly expenses. Identify where you can cut costs. Look carefully at the following areas:

Utility bills: Gas and electric are especially important. Adjust your thermostat, turn off office equipment when you’re not home, lower your water heater thermostat. Wash your clothes with cold water rather than hot, and line-dry them instead of using your dryer. Only run your dishwasher when it’s completely full, or opt to wash dishes by hand. Txt and skype rather than make phone calls.

Subscriptions and miscellaneous fees: Cut any subscriptions and fees that are not essential. Be sure to check app subscriptions as the number that you have can mount up over time.

Eating out: Dining out or going out for drinks can add up quickly. Eat more meals at home, and host gatherings at your house rather than at cafes and bars.

Purchases: You don’t have to stop all purchases, but you can be more strategic about when and how you splurge. Set up a splurge account and only buy when there is money to spend. Look at your spending on clothing, accessories, electronics, hobbies, and entertainment. Before you pull the trigger on any item, ask yourself, “Do I really need to make this purchase, or can I get by without it?” If it’s not something you truly need, don’t buy.

Hopefully, you can find enough excess in your personal budget that you can cut down on expenses and still maintain your current lifestyle. If you find it’s not that easy, you may need to take more drastic measures. Taking on a flat mate or moving to a shared living situation can easily save you hundreds of dollars on housing expenses. If you live in a bikeable area with a good public transport system, or if your significant other has a reliable vehicle, ditching your car can save a ton on gas, maintenance, repairs, insurance premiums, registration, and loan payments. Remember, it’s only temporary until you’re debt-free.

Increase your income

If you’ve got some free time you can increase your take-home income by making money on the side. Here are some ways to make extra cash:

- Downsize and declutter: sell your unwanted stuff

- Freelance writing: sell your words

- Classes: sell your knowledge

- Bed and Breakfast: sell space in your home

- Farmers’ Market: sell your produce and gourmet foods

- Crafts and art: sell your creativity

- Call centers: sell your time and voice

- Sewing and alterations: sell your handiwork

- Used book sales: sell your old paperbacks

- Consulting: sell your knowledge

- Medical transcription: sell your computer skills

- Do odd jobs

For more ideas: https://www.moneycrashers.com/ways-make-money-from-home/ Written for the American market but quite comprehensive, with lots of ideas and detailed instructions on how to set yourself up.

2. Budget for debt repayment

Budgeting is no one’s favorite pastime, but you’ve got to create a realistic debt management plan. Write down your monthly net income and subtract your budgeted expenses from that number. Based on this calculation, designate a specific dollar amount you can use to pay your student debt balance each month. Be sure to leave a little wriggle room in your budget for fluctuations and emergencies. For example, if you have $600 remaining after meeting your budget obligations, consider designating $400 to debt payments and leaving a $200 buffer for unexpected expenses. As you continue to make payments, your minimum monthly obligations decrease. Don’t be tempted to decrease your actual payment when this happens, as paying only the minimum won’t make a serious dent in your principal balance. Making higher payments can save you thousands in interest and can mean you’re debt-free years – or even decades – sooner.

Debt Consolidation

Debt consolidation entails consolidating multiple sources of debt – such as multiple credit cards, student loans, auto loans, and mortgages – into one loan. The biggest benefit of debt consolidation is that it simplifies your obligations. You’re only responsible for one payment every month, so you’re less likely to forget a payment and get hit with late fees. You may also be able to reduce your total monthly payment for all your obligations by agreeing to a long-term loan.

Set your repayment schedule

Once you’ve determined how much you can allocate toward debt repayment and you know your interest rates, decide how you’re going to pay off the debt. Pay debt with the highest interest first.

Stop the cycle of debt

The last thing you want is to successfully pay down your debt, only to find yourself in debt again months or years later, for example having a credit card debt. Change the way you handle your finances and the way you think about money in order to keep yourself out of trouble.

3. Use cash only for non-essentials

Leave your credit card at home. To use the envelope budgeting method, pull out a certain amount of cash each month and stick it in an envelope. Use that instead of your credit card for non-essential purchases. When the money’s gone, you’re done for the month. If any cash is left over, you can put it toward your credit card repayment or deposit it in your emergency fund.

4. Track your progress

It’s easy to lose motivation when you’re dealing with a large debt. Tracking your progress is one way to keep yourself excited and focused on what you’re accomplishing.

5. Stay accountable

Find an accountability buddy and keep each other up to date on your financial progress. This could be a significant other, close friend, or family member. Talk on a regular basis – maybe once a month or every two months – about what repayments you’ve made on your credit cards.

Digging yourself out of debt including student debt isn’t easy. To do it successfully, you’ve got to change your financial behaviour and prioritise where you spend your money. It may take some time to get used to the changes, but ultimately you gain money management skills that can help you live a financially savvy life for years to come.

Making SMART money goals

SMART stands for Specific, Measurable, Achievable, Realistic, Time bound.

By ensuring your goal meets these criteria, you are more likely to achieve it. Set a goal, and then run it through WHAT, WHO, WHEN, WHERE, HOW, and WHY questions to reveal the reality of your goal. For example:

Goal: I want to reduce my spending.

What: Be specific so someone else can understand what you want to achieve.

I want to reduce my spending by $50 per week.

Who: Who is going to do this? Does it involve anyone else?

I am going to do this myself.

How: How are you going to achieve the goal?

I will give up one of my two coffees out a day. For seven days at $4.50 per coffee this will save me $31.50 / week. I will walk to University three days a week and save my bus fare of $3.50. This will give me another $10.50/ week. I will give up my Friday treat of sushi and bring sandwiches. That will save me another $8.00. I will put this $50 towards minimising my student debt.

When: By setting a timeframe, you can ensure your goal is achievable within your schedule and you can assess your progress.

I will start tomorrow, through until the end of the University year. In those 26 weeks, I will save $1,300.

Where: Some goals require physical space. By answering this question when you set the goal you make it more specific and more likely to be achieved.

The answer to how also addresses where – at the coffee shop, on the trip to University, and at lunch time on Fridays.

Why: The “why” statement helps you to connect to the purpose of your goal. It’s good to remember when you are tempted to stray from your plan.

Because my student debt freaks me out and this might seem like a small thing but it is me starting to take control of it. I understand even small actions count and it will help me move onto bigger money goals.

Next, ask yourself is this something I really want?

I don’t really want to give up those things but I really want to feel some control over my debt so I will focus on how I will feel to save $50 per week going onto my debt. Yes this is something I really want.

Finally, look back over your answers and check:

Is this goal:

Specific?

Measurable?

Achievable?

Realistic

Time bound?

Something I really want?

When you can answer “yes” to all of these points, you have a SMART goal and are ready to put it into action!

Related Links

How to Get Out of Credit Card Debt Fast – 5-Step Pay-off Plan

The 5 step plan on this page is adapted from the linked article by Patricia Poladian on MoneyCrashers.com

Tackling Debt

Sorted teaches that tackling debt can be the best way to get ahead. This page leads to resources on all areas of debt.

11 Side Businesses You Can Start With Just Your Phone

More ideas on increasing your income, with businesses you can start using your phone.

Want more?

The resources from the first workshop in this series, “Understanding Money Habits” are available here